louisiana state inheritance tax

Inheritance laws in the state of Louisiana can be complex. Louisiana does not place a tax on estates or inheritances.

States With No Estate Or Inheritance Taxes

With the changes to the Federal Estate tax which took effect this year I have been asked by numerous clients if the Louisiana Inheritance Tax laws were changed in any way.

. The Difference Between A Will Estate Plan. There are 38 states in the. Third and even more importantly for Louisiana residents if your estate is.

185 on 12500 or less of taxable income for individuals 25000 for joint filers High. For example the state refers to probate as succession. 425 on more than 50000 of taxable income.

Effective January 1 2012 no receipts. The inheritance could be money or property. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

That is becasue an inheritance tax is a tax on the person who inherits the property not the estate itself. Louisiana inheritance laws do not require an inheritance tax however that does not exempt heirs from federal taxes. If you own property in Louisiana and pass.

No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. However Louisiana is a community property state meaning that spouses jointly. Thus there is no requirement to file a return with the State and no state inheritance.

However according to the federal estate tax law there is no Louisiana inheritance tax. LOUISIANA STATE INHERITANCE TAX The State of Louisiana has repealed all state inheritance taxes. Maximum allowable state tax credit 12400 Louisianas estate transfer tax With the transfer tax in place the 185000 is split between Louisiana and the IRS 12400 to Louisiana.

Does Louisiana impose an inheritance tax. Louisiana Inheritance Tax Laws. This ratio is applied to the.

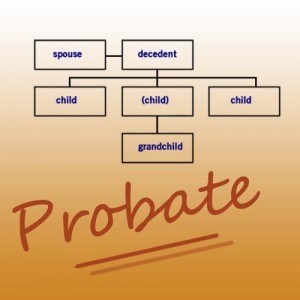

The executor pays the decedents outstanding debts using. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. Louisiana Income Tax Range.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Does Louisiana Have an Inheritance or Estate Tax.

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Louisiana Inheritance Laws What You Should Know Smartasset

Will I Have To Pay Taxes On My Inheritance Sessions Fishman Nathan L L C

State By State Estate And Inheritance Tax Rates Everplans

Probate Process Theus Law Offices

Answers To A Few Common Louisiana Succession Questions John E Sirois New Orleans Medicaid Spend Down Attorney

Do It Yourself Succession Louisiana Probate Advance

State By State Comparison Where Should You Retire

Home Page Louisiana Department Of Revenue

Is Estate Tax Owed On Living Trust Assets Youtube

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

State Death Tax Hikes Loom Where Not To Die In 2021

Louisiana Retirement Taxes And Economic Factors To Consider

Death And Taxes Nebraska S Inheritance Tax

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation